The Harmony Plan

The definition of harmony is: An orderly or pleasing combination of elements in a whole.

We named our plan Harmony because it brings together all of the elements involved in preplanning and it does so in a way that adds simplicity and convenience to a process that can often be difficult and confusing. The Harmony Plan provides a legal will kit, our “Funeral and Cemetery Plan” and our estate settlement package which consists of our “Getting Things in Order” preplanning guide and the “eState of Mind” estate settlement guide.

People experience grief differently. Losing a loved one can be one of the most difficult events someone may ever live through. When we lose a loved one, the grieving process can be much more traumatic when there is additional stress, that is why experts recommend preplanning ahead of time. Preplanning or ‘getting things in order’ will help your survivors avoid unnecessary stress.

Preplanning is very important, yet people often procrastinate doing it for 3 different reasons:

A) A fear or discomfort from thinking about one’s own death.

B) Not knowing where to start. Who do I call… A lawyer? An accountant? A funeral director? An insurance agent? A cemetery director?

C) Money.

Discussing death will not cause a death to occur any sooner but not addressing it will have a negative impact on your family. Families pay the price when loved ones do not preplan.

When it comes to not knowing where to start or concerns about costs involved with preplanning, we suggest starting with us. Our Harmony Plan is designed to do 2 things: address preplanning issues and reduce the costs involved.

The Harmony Plan consists of the following:

Legal Will Kit

that can be used to complete a first will, or to replace an outdated existing will. A will is very important because without one, someone other than you may decide who gets your property and possessions, who will administer and carry out your wishes and who will raise your children.

Experts say a will should be reviewed after significant life and economic changes such as retirement or the birth of a new heir. Our Will Kits consist of 8 pages and were designed with a very easy to use format that includes detailed instructions.

Current retail value: $199.00

Our current price: $0

For a limited time, we are giving away our will kits for no cost as part of our Harmony Plan. No purchase necessary.

"Getting Things in Order"

estate planning guide is a 'must have' resource for anyone who is planning their final wishes or 'getting things in order'. The guide presents a detailed list of the documents and information your family will require upon your death. It outlines the steps necessary for funeral and cemetery planning as well as what is needed to 'settle' or 'close' the deceased's estate. This estate planning guide presents all of the necessary information that is needed when someone dies and puts it all into one place.

Our current price: $0

Our “Getting Things in Order” estate planning guides are free as part of our Harmony Plan. No purchase necessary.

"eState of Mind"

Canadian Estate Settlement Guide, licensed exclusively to Final Expense Solutions, is a comprehensive help guide and set of documents that are required to 'close' or 'settle' a loved one's estate. The easy-to-use guide includes over 100 documents such as the CPP application and the CPP survivor’s application as well as other government documents required for applying for benefits, letters to several institutions such as Equifax and TransUnion, forms to retire a driver’s license, health card and SIN Card and documents for tax related matters such as RRSP and RRIF annuitant changes.

Current retail value: $399.00

Our current price: $0

For a limited time, we are providing eState of Mind, Estate Canadian Settlement Guides for no cost as part of our Harmony Plan. No purchase necessary.

Free, No-Obligation Consultation

with a Final Expense Solutions advisor who is licensed as an insurance advisor in the province they reside in. In addition, the advisor has spent additional hours becoming educated in specific issues related to estate planning such as Canada Pension Plan benefits, powers of attorney and estate tax issues. The advisor also spends 30 hours in a classroom setting with a funeral and cemetery professional learning the basics about funeral and cemetery arrangements.

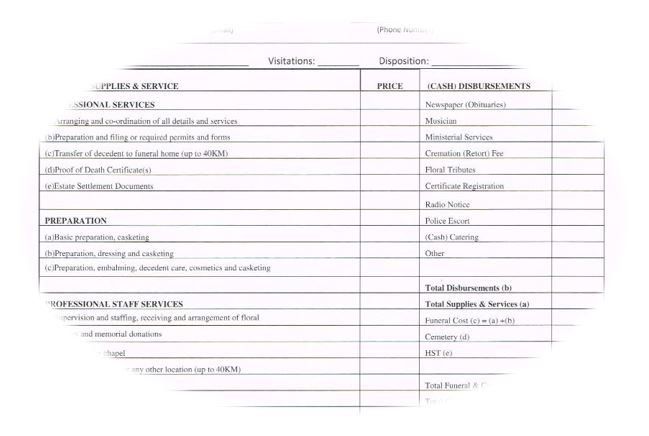

“Funeral and Cemetery Plan”

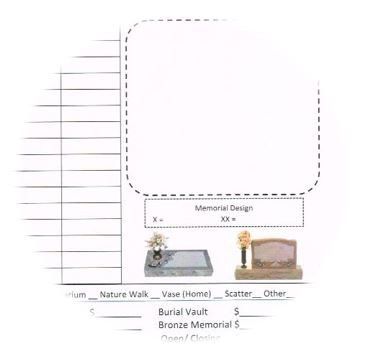

is a form completed between the advisor and the client that provides the opportunity to document final wishes and obtain an estimate of those costs based on prices from local establishments. This document details itemized goods and services.

Some examples of items that would be documented would be such things as ‘type of funeral service’, ‘casket’, ‘flowers’ ‘grave opening and closing’ and ‘cremation structure’. A copy of this document is provided to the client and a copy is kept with the head office and forwarded to the preferred Funeral Home and/or Cemetery at the time of need, upon request.

*The “Funeral & Cemetery Plan” is a plan for arrangements and an estimate based on prices from local establishments. Only a funeral director, licensed Funeral Preplanner, licensed cemetery sales representative or cemetery director can offer a contract for goods and services guaranteed by a funeral establishment or cemetery. Prices are not guaranteed and will increase with inflation.

Affordability

Final Expense Solutions uses insurance products for funding that are tailored to the funeral and cemetery plan and the ‘insurability’ of the client. This means that…

- The policy can be paid for over someone’s lifetime which often results in a considerably smaller monthly payment

than if it was paid for over 10, 15 or 20 years.

- The cost can be lower based on health and lifestyle. For example, a non-smoker might pay less than a smoker and someone who has never had cancer might pay less than someone who has. Medical exams are not required.

- Our plans can be customized to keep up with the average rate of inflation. Funeral establishments and cemeteries offer contracts that guarantee that the prices of their products and services never go up. We can provide policies with built-in inflation amounts, and in most cases, still cost less on a ‘per month’ basis than the plans the funeral homes and cemeteries in Ontario offer.

- Our policies generally pay out a death benefit within 24 hours, often with only a confirmation from a funeral home that the death has occurred. The policies we use also contain some benefits that could reduce the cost of a funeral. Benefits such as the ‘travel benefit’ that is included with most of our policies for free while funeral homes charge around $600 for a similar benefit.

*Funeral Homes in Ontario offer annuity-based group life insurance plans that must be paid over a set term such as 10 or 15 years commonly resulting in higher monthly costs. The plans the funeral homes use generally do not offer lower prices for clients in good health. In Ontario, only a licensed insurance advisor can sell an individual, underwritten life insurance product. Final Expense Solution advisors are licensed insurance advisors and can offer these policies.